Web3 and the Future of Payments

Web3 is meant to be the next big evolutionary leap forward in the internet. For payments, it promises to completely revolutionise how we send and receive money. But what is Web3, exactly?

Web1 vs Web2 vs Web3

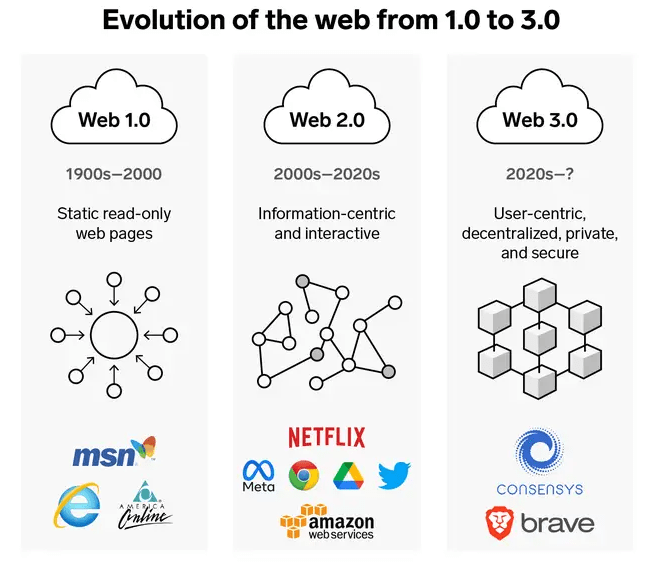

Let's start at the beginning. Web1 is basically the internet as we know and love today - think of self-hosted web pages with static content that are linked and shared via URLs.

Then there was Web2, which is essentially the user-generated web. It is a network of social interactions linking users to each other on platforms like Instagram or Facebook via algorithm-based data. Information is shared by 'liking', 'reposting' or 'sharing' with your own comments.

Web3 takes the internet one step further. While the exact definition of 'Web3' is still being clarified, its primary principle is decentralisation. This means that the 'internet' will not be controlled by a third-party corporation or government, as is the case with today's internet.

Source: Business Insider

Web3 and Payments

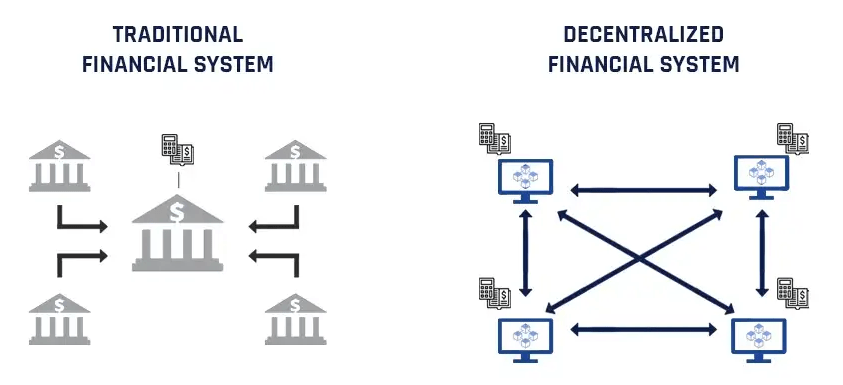

The main difference between a Web2 and Web3 payment is decentralisation. In a Web2 payment, the infrastructure relies on centralised banking systems that exclude people who don't have access to a bank account. Payments made between individuals or corporations are passed through third-party institutions that are in control of everything from data security, transaction times and costs.

Web3 seeks to upend the centralised power structure of Web2 and shift it back to users through the use of open standards and protocols. In Web3, application data are no longer stored in private databases but rather on a blockchain that anyone can write to and read from. The lack of centralised data storage makes the system immune to a single point of failure, control or censorship like in Web2.

Source: Stably

The peer-to-peer infrastructure in Web3 means that sending payments does not require the sender to register for financial services. And because the data in Web3 is encrypted, senders also don't need to give permission for companies to access their personal or financial information. By eliminating the need to convert complex currencies, Web3 removes the need for high remittance fees and long settlement times typical of international transfers in Web2.

Increasing Adoption of Web3 Payments

Although concept of Web3 has been around for over a decade, the growing dominance of centralised entities over the internet and the use of people's data has resulted in a push towards decentralisation.

Many global payments providers have been exploring the opportunity of Web3. Payment processing giants Visa and Mastercard both announced partnerships with cryptocurrency and wallet exchanges. The Q4 2021 quarter saw $2.5 billion in payments made with crypto-connected Visa cards, compared to $47.6 trillion in total Visa payments. Mastercard announced in April 2022 that it launched its first crypto-backed credit card.

Paypal has also been testing the viability of Web3 payments. In addition to implementing blockchain technology in its payment rails, such as allowing cryptocurrencies to be traded via its platform, it also has indicated that it wants to launch its own stablecoin.

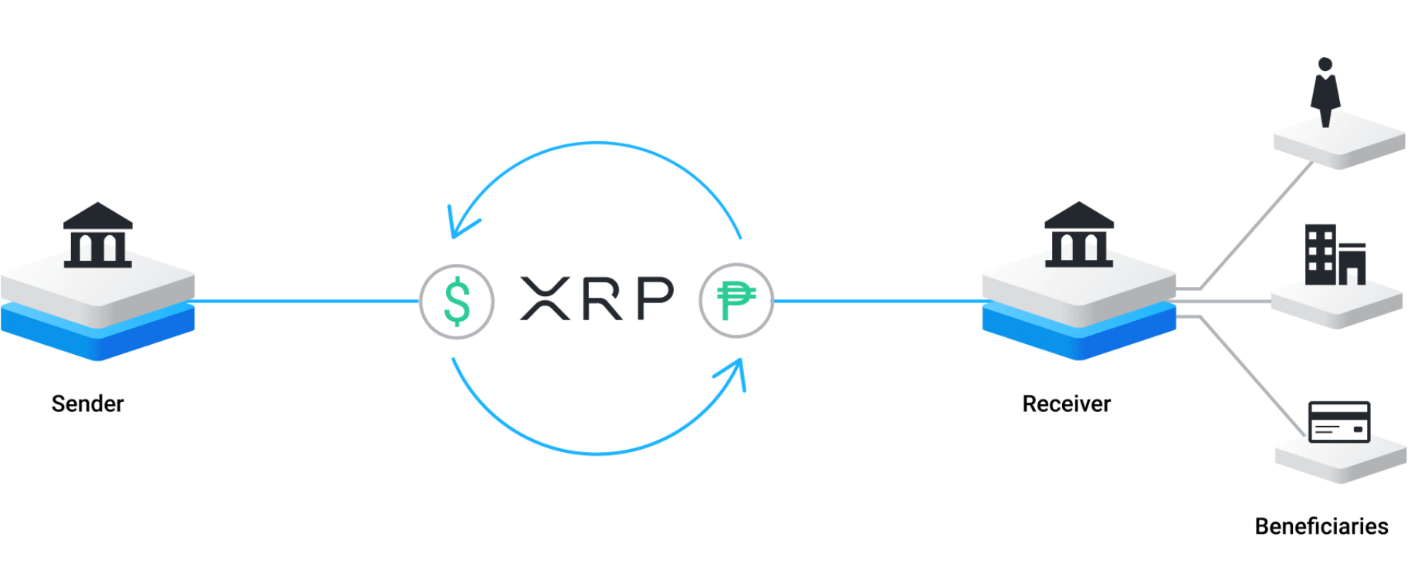

In the B2B payments universe, there has been an uptick in business developing blockchain and crypto settlement capabilities. Since 2017, Flash Payments has been using Ripple's On-Demand-Liquidity service in our payment corridor, leveraging the digital asset XRP and blockchain technology to eliminate pre-funding, reduce transaction costs and increase settlement speeds.

Source: Ripple

Web3 is Not Without its Challenges

Just like the earlier versions of the internet, Web3 has fundamental challenges that need to be addressed. Because blockchain technology is trustless by default, Web3 remains vulnerable to certain types of hacks. The current conversations around Web3 and payments rest on the assumption that users are united in altruistic goals, which is unrealistic given the human factor involved in the peer-to-peer model.

The sheer complexity of Web3 applications means that adequate literacy among the masses is not likely. In the current form, with its technicalities and jargon, Web3 is simply too complex for the wider population to comprehend.

Web3's reliance on crypto assets as a form or payment or storage makes the system susceptible to large fluctuations in their value. Decentralised currencies without centralised control can be extremely volatile, resulting in high transaction costs and making cross-border transactions difficult.

And crucially, the regulatory picture for Web3 remains unsettled, with calls for greater clarity on some assets and more consumer protection for funds held in custody.

Despite these challenges, the transformational promise of Web3 for payments cannot be ignored. The ability to address the challenges will define the future of Web3 and beyond.