Ready to grow your financial advisory business?

International money transfers are an area of opportunity for financial advisors to improve customer outcomes and enhance their ‘trusted advisor’ status.

Australians continue to face problems using banks for international payments

Australians still overwhelmingly rely on banks for their foreign exchange (FX) services, despite being the most expensive option for transferring money overseas.

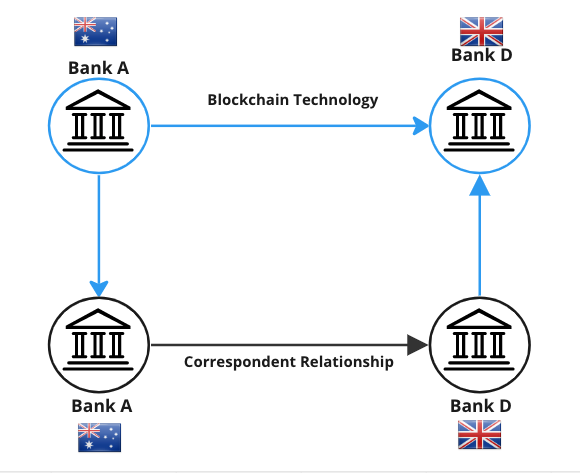

Banks use the legacy SWIFT payments system, which relies on a web of correspondent banks to move money around the globe. Throughout this largely manual process, each bank involved charges a processing fee, increasing the time and cost of each transaction. This is on top of the exchange rate margin banks levy to convert money between currencies, which can exceed 5.0%.

Consumer pain points in the current SWIFT system:

❌ Cost: higher costs due to more transaction fees

❌ Speed: slower transaction speeds thanks to correspondent bank intermediaries

❌ Transparency: lack of visibility around funds delivery times

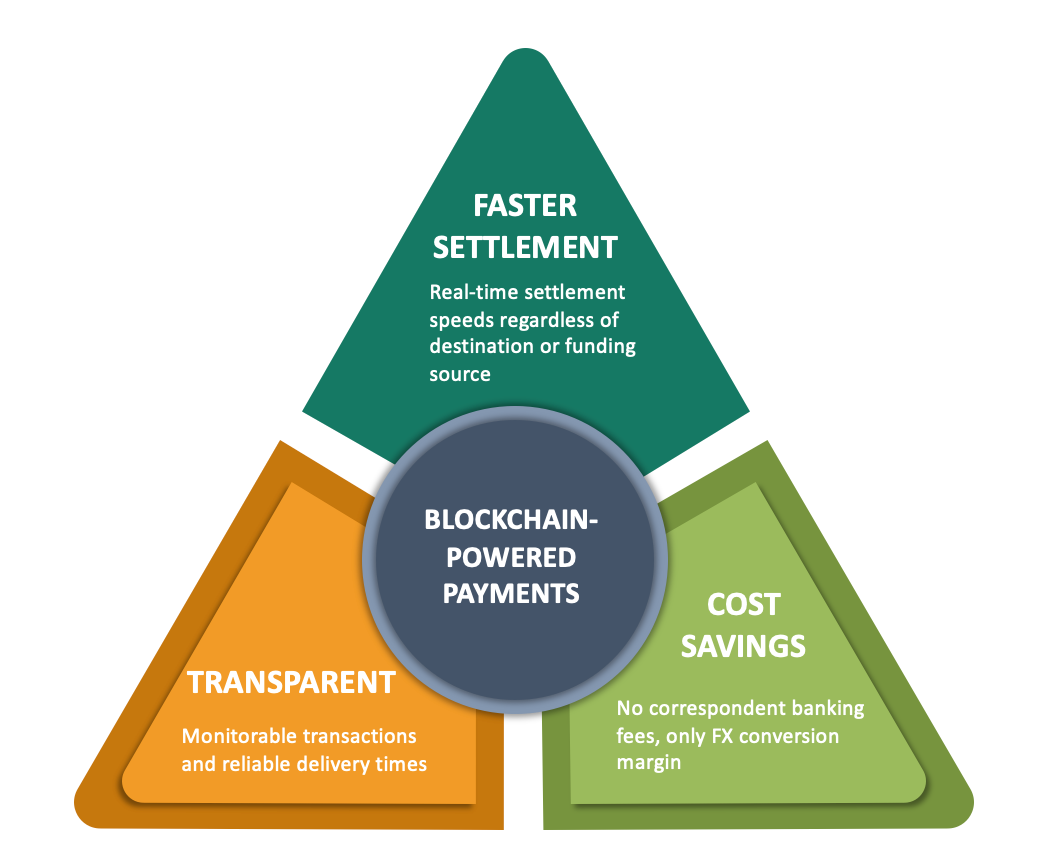

New technology is addressing the pain points in the legacy SWIFT system

Unfortunately, many Australians are unaware that there are better, cheaper alternatives to the banks for their international money transfers.

Blockchain-powered payments system are solving many of the problems plaguing the traditional SWIFT model. In this system money is transferred using cryptographically secure technology that provides trusted real-time verification of transactions and end-to-end payment flow. It completely cuts out correspondent bank intermediaries, reducing payment delays and costs.

Australians can benefit from blockchain-powered payments

International money transfers are a growth opportunity for financial advisors

Financial advisers are well-positioned to benefit from the rise of blockchain-powered payments:

- Limited consumer awareness of non-bank FX providers suggests that clients would be receptive to learning about a cheaper, faster alternatives.

- International money transfers sit outside of mainstream service propositions, indicating this is an area of potential growth and differentiation.

Advisers moving quickly to offer a better, more cost-effective international payments solutions will have a head-start over the competition.

FlashManage is bringing blockchain-powered payments to financial advisors and their clients

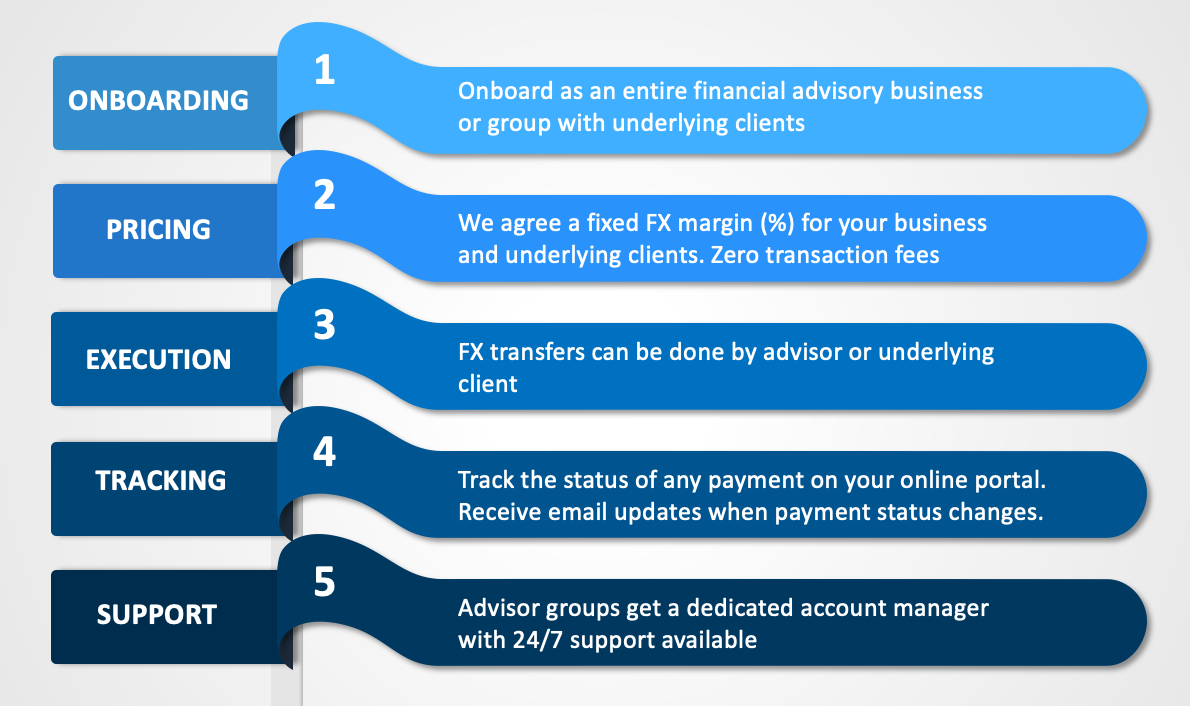

FlashManage is Flash Payments unique advisors mode, designed specifically to give financial advisors and their clients access to blockchain-powered payments technology.

FlashManage Key Features:

Advisors Benefit from FlashManage

A recent financial market report found that 71% of financial advisors believed that including international transfers in their service offering would increase their 'trusted advisor' status with clients.

So what are you waiting for?