The Surge of Digital Remittances: Analysing the Growth Trajectory

The ascendancy of the digital remittance market is a testament to the profound impact of technological evolution on financial ecosystems. Projected to reach a stellar $33.9 billion by 2026, digital remittances are carving a new narrative in the global money transfer landscape.

Unveiling the Growth Engine:

Several cogent factors contribute to the burgeoning digital remittance sphere:

Technological Advancements:

Digital platforms have revolutionised the ease and speed of cross-border money transfers. Blockchain technology, for instance, is heralding a new era of transparency and reduced fees.

Consumer Behavioral Shift:

The digital age consumers crave convenience and immediacy, traits intrinsic to digital remittances. The cumbersome process of traditional money transfers is being overshadowed by the allure of instant, online transactions.

Global Diaspora:

The ever-expanding global diaspora is a substantial driver. As individuals traverse borders, the need for hassle-free, cross-border money transfers escalates.

Smartphone Penetration:

The ubiquity of smartphones and internet connectivity has democratized access to digital remittance platforms, especially in regions where banking infrastructures are scant.

Regulatory Facilitation:

Progressive regulatory frameworks in several regions are fostering a conducive environment for digital remittance platforms to thrive.

A Closer Look at the Numbers:

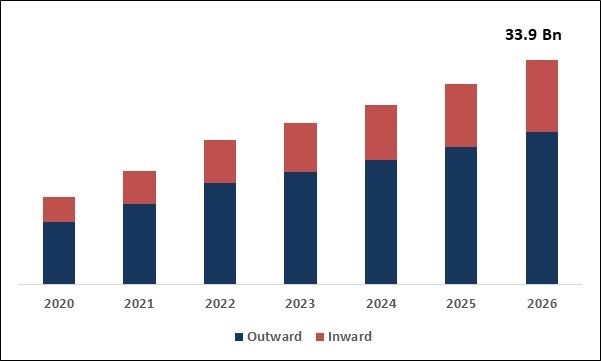

The leap from $14.5 billion in 2019 to an anticipated $33.9 billion by 2026 is a narrative of resilience and innovation in the digital remittance arena.

Global Digital Remittance Market Size

A line chart illustrating the growth of the digital remittance market from 2019 to 2026. (Source: kbvresearch.com)

Navigating the Future:

The trajectory of digital remittances is a precursor to a broader digital financial ecosystem. As digital remittance platforms continue to proliferate, forging partnerships with traditional financial institutions, a hybrid financial ecosystem is emerging.

Conclusion:

The crescendo of digital remittances is more than a transient trend; it's a significant chapter in the global financial narrative. As we stride into a future where digital interlinks with the traditional, the essence of remittances remains unchanged – fostering connections, nurturing hope, and bridging distances, albeit digitally.